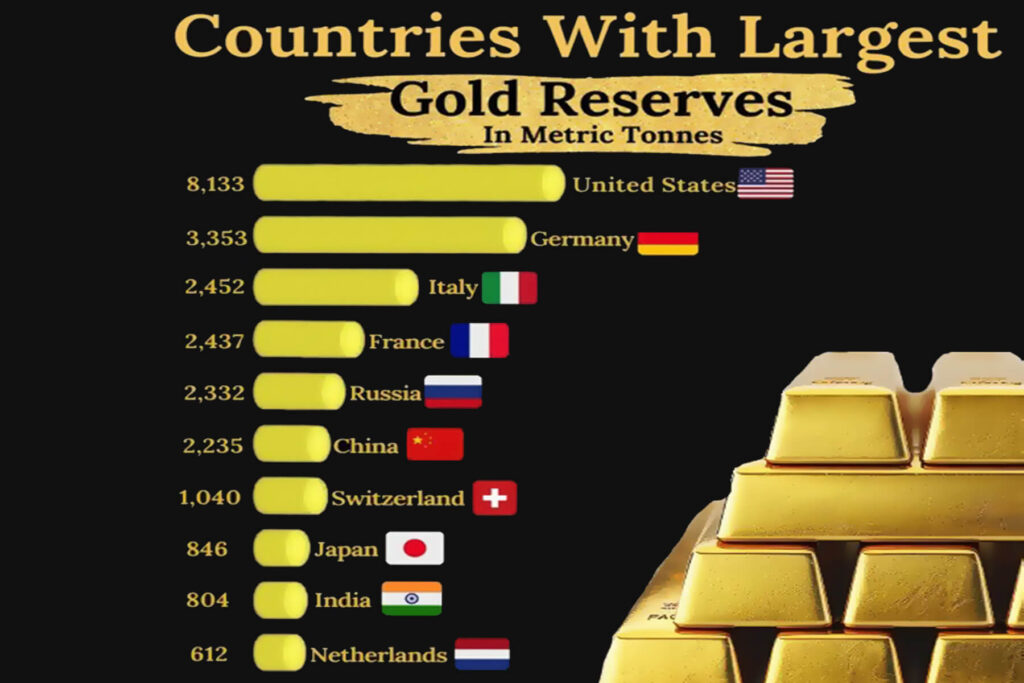

Top 10 Countries with Highest Gold Reserves in 2024

Gold reserves are critical to a nation’s economic stability, serving as a safeguard against currency fluctuations and financial crises. These reserves are maintained by central banks and act as a store of value, reflecting a country’s commitment to sound monetary policies. Let’s explore the top 10 countries with the highest gold reserves according to the latest World Gold Council reports.

United States

The United States ranks first with approximately 8,133.46 tons of gold reserves, accounting for about 72.41% of its total foreign reserves. This significant holding is primarily stored in secure locations such as Fort Knox, the Denver Mint, and the West Point Bullion Depository.

The U.S. has maintained its leading position due to historical accumulation during the gold standard era and ongoing purchases by the central bank. Gold serves as a critical asset for the U.S., providing financial stability and acting as a hedge against inflation and currency fluctuations.

Germany

Germany holds 3,352.65 tons of gold reserves, representing about 71.46% of its total foreign reserves. Germany’s gold is primarily stored in various secure locations, including the Bundesbank’s vaults in Frankfurt and repatriated gold from foreign storage facilities in New York and London.

The country has a long-standing tradition of valuing gold as a safe-haven asset, particularly following economic turmoil in the 20th century. Germany’s substantial reserves reflect its commitment to financial stability and sound economic policies, providing a buffer against potential crises.

Italy

With 2,451.84 tons of gold reserves, Italy ranks third globally, constituting around 68.33% of its foreign reserves. The Italian central bank manages these reserves, which are stored primarily in Rome and other secure locations across the country.

The Italian government views gold as an essential asset that provides security against economic instability and inflationary pressures. Furthermore, Italy’s robust gold reserves bolster its position within the Eurozone, enhancing its financial stability and international standing.

France

France comes in fourth place with 2,436.88 tons of gold reserves, making up approximately 69.99% of its total foreign reserves. The Banque de France manages these holdings, which are stored securely in Paris and other locations.

France has maintained its gold reserves as part of a broader strategy to ensure financial stability and protect against economic downturns. Historically, French policymakers have recognized gold’s role as a safe-haven asset during periods of uncertainty.

Russian Federation

Ranking fifth is the Russian Federation, with 2,332.74 tons of gold reserves, which accounts for about 29.47% of its total foreign reserves. Russia has aggressively increased its gold holdings over recent years as part of a strategy to diversify away from reliance on the U.S. dollar amid geopolitical tensions and sanctions from Western nations.

China

In sixth place is China, holding 2,191.53 tons of gold reserves, which constitutes about 4.91% of its total foreign reserves. China’s central bank has gradually increased its gold holdings over the past decade as part of a broader strategy to diversify its assets and reduce dependence on foreign currencies like the U.S. dollar.

Gold is viewed as an essential component in enhancing China’s monetary policy flexibility and supporting its growing economy amidst global uncertainties. The Chinese government actively promotes domestic gold consumption while strategically accumulating international reserves to boost national security and economic resilience.

Japan

Japan ranks seventh with 845.97 tons of gold reserves, making up about 5% of its total foreign reserves. Japan’s central bank holds these reserves primarily as a hedge against inflation and currency fluctuations amid aggressive monetary policies over recent years. Although Japan does not heavily rely on gold compared to other nations, it recognizes the importance of maintaining some level of precious metal holdings to bolster investor confidence during periods of economic volatility.

India

India ranks eighth with 800.78 tons of gold reserves, constituting approximately 9% of its foreign exchange reserves. Gold holds immense cultural significance in India; it is considered a symbol of wealth and status while being integral to various rituals and celebrations throughout the year.

The Reserve Bank of India actively manages these holdings and regularly increases them to strengthen financial stability amid rising global uncertainties and inflationary pressures. India’s growing affluence further fuels the demand for gold domestically, making it one of the largest consumers globally.

Netherlands

The Netherlands, ranked ninth with 612.45 tons of gold reserves is about 61% of its total foreign exchange holdings, maintains significant assets primarily stored within national vaults for security purposes.

Turkey

Turkey ranks tenth in the world with 584.93 tons of gold reserves as of 2024, marking a significant increase from previous years. The Turkish Central Bank has emerged as one of the largest buyers of gold among central banks globally, having increased its reserves dramatically from just 114 tons in 2017 to its current levels. Approximately 34% of Turkey’s foreign exchange reserves are now held in gold, underscoring its importance in the national economy.

| Rank | Country | Gold Reserves (Tons) | Gold Reserves (Millions) | Holdings (%) |

| 1 | United States of America | 8,133.46 | 609,527.85 | 72.41 |

| 2 | Germany | 3,351.53 | 251,166.13 | 71.46 |

| 3 | Italy | 2,451.84 | 183,742.52 | 68.33 |

| 4 | France | 2,436.97 | 182,628.35 | 69.99 |

| 5 | Russian Federation | 2,335.85 | 175,050.59 | 29.47 |

| 6 | China | 2,264.32 | 169,689.52 | 4.91 |

| 7 | Japan | 845.97 | 63,397.87 | 5.15 |

| 8 | India | 840.76 | 63,007.20 | 9.57 |

| 9 | Netherlands | 612.45 | 45,897.75 | 61.61 |

| 10 | Turkey | 584.93 | 43,834.93 | 0.00 |

| 11 | Portugal | 382.66 | 28,677.06 | 74.08 |

| 12 | Poland | 377.37 | 28,280.52 | 13.49 |

| 13 | Uzbekistan | 365.15 | 27,364.77 | 75.20 |

| 14 | United Kingdom | 310.29 | 23,253.15 | 13.44 |

| 15 | Kazakhstan | 298.80 | 22,391.95 | 56.04 |

| 16 | Spain | 281.58 | 21,101.64 | 20.16 |

| 17 | Austria | 279.99 | 20,982.76 | 63.21 |

| 18 | Thailand | 234.52 | 17,574.99 | 7.83 |

| 19 | Singapore | 228.86 | 17,150.61 | 4.49 |

| 20 | Belgium | 227.40 | 17,041.21 | 39.90 |

Conclusion

Gold reserves are a cornerstone of financial stability for these countries, providing a tangible asset that can back up their currency. Central banks hold around 20% of all mined gold, underscoring its significance in maintaining financial security and liquidity. By managing substantial gold reserves, these nations bolster their economic resilience and influence on the global stage.

I hope this comprehensive summary meets your needs! If you need further information or have any adjustments, feel free to let me know.