Could tariffs cause another big market crash like the one in 1930? Many people are talking about Reciprocal Tariffs imposed by USA President Donald Trump on 2nd April, 2025. Due to this there is a global stock market down fall happened in this week and many talks that there is a possible recession is coming in near future.

It is hard to know exactly what will happen, but we can look to the past for proofs.

Impact of Trump’s Reciprocal Tariff

The announcement of President Donald Trump’s Reciprocal tariffs sent shockwaves through global stock markets, triggering huge losses and raising concerns about a potential global recession.

Here’s a detailed breakdown of the impact:

Global Stock Market Fall

- Asian Markets:

- Japan’s Nikkei down by 4%

- South Korea’s Kospi down by2.7%

- Hong Kong’s Hang Seng down by 2.4%.

- Australia’s ASX 200 down by 2%

- European Markets:

- Pan-European STOXX down by 1.5%,

- Germany’s DAX down by 2.5%

- France’s CAC down by 2.2%

- U.S. Markets:

- The S&P 500 experienced a 4.8% drop, erasing $2.4 trillion in market value

- The Dow Jones Industrial Average plunged over 1,600 points (4%)

- Nasdaq tumbled nearly 6%, marking its worst day since the COVID-19 pandemic.

Economic Fallout in the USA

- Market Capitalization Loss: The U.S. stock market saw a staggering $5 trillion wiped out in just one week.

- Sector-Specific Impact: Tech giants like Apple and Amazon faced significant losses, with Apple’s market value dropping by $300 billion. Retailers like Nike and Ralph Lauren faced declines of 14.5% and 16%, respectively.

- Inflation and Recession Risks: Analysts predict a 2% increase in the Consumer Price Index, with potential GDP contraction in the fourth quarter.

Learning from the Past Tariffs and Market Crashes

The last time the U.S. used tariffs on a large scale was in the 1930s. This led to a major recession and a huge stock market crash. For many years, the U.S. did not use tariffs because of how bad things got back then. Now, there is a question of will tariffs cause history to repeat itself?

USA Stock Market Boom in 1920s

Before the Great Depression, the stock market was booming. The Dow Jones grew a lot in just a few years. This was like how the NIFTY has grown recently. People were excited about the stock market.

Risky Investing

Back then, many people were new to the stock market. They invested on margin, which means they borrowed money to buy stocks. This made the market risky because people could lose a lot of money if the stock prices went down. Today, people are also putting a lot of money into the market, sometimes even taking money from their savings.

Investors borrowed up to 90% of the stock’s value. This made the market very risky. There was also a lot of hype in the media, which caused stock prices to rise too high. This is similar to how some companies today are talked about a lot in the news.

Lack of Rules in Stock Market

There were not many rules for the stock market back then. This meant that some people could manipulate the market. It’s hard to say if that happens today, but it’s something to consider.

The Dow Jones tripled in value from 1924 to 1929. As the market went up, more people wanted to invest. It was a time of excitement, and everyone was talking about stocks.

The Tariff Act of 1930: A Solution or Mistake?

The U.S. government realized that the economy was not doing as well as the stock market. They wanted to keep the economy growing. So, they decided to put tariffs on goods coming into the U.S. The idea was that this would help American businesses.

The Tariff Act of 1930, also known as the Smoot-Hawley Act, was signed into law by President Herbert Hoover.

In 1930, USA Congress passed a law that put tariffs on about 20,000 imported items. The tariffs ranged from 20% to 100%. The goal was to protect local farmers and businesses. This is similar to what Trump want to do today.

Trade War 1930

Other countries did not like the tariffs. They put their own tariffs on goods from the U.S. This started a trade war. Countries kept raising tariffs on each other. This hurt global trade and cooperation. The amount of trade around the world fell by 60%.

Markets do not like trade wars. The stock market started to react badly. This is like what we are seeing today, with markets around the world falling down.

Stock Market Crash of 1929

On September 3, 1929, the Dow Jones was at 381. By July 8, 1932, it had fallen 90% to 41. This was a huge drop. It wasn’t just because of the tariffs. The market was also overvalued, and there were not enough new buyers to keep prices up.

The U.S. stock market lost billions of dollars in value in just a few weeks. Many companies’ stock prices fell to almost nothing. American investors lost a lot of money. About 1.5 million Americans lost their investments.

The Dow Jones did not reach its 1929 high again until 1954. It took many years to recover from the crash.

Warnings by Economist was Ignored

When the government was creating the tariffs, many people warned that it was a bad idea. More than 1,000 American economists signed a petition asking the president not to sign the bill. They said that it would raise prices, cause other countries to retaliate, and make the economic downturn worse. But the president did not listen.

Some experts believe that the tariffs caused the Great Depression to be worse and last longer. Others think that the tariffs were not the main cause, but they did not help.

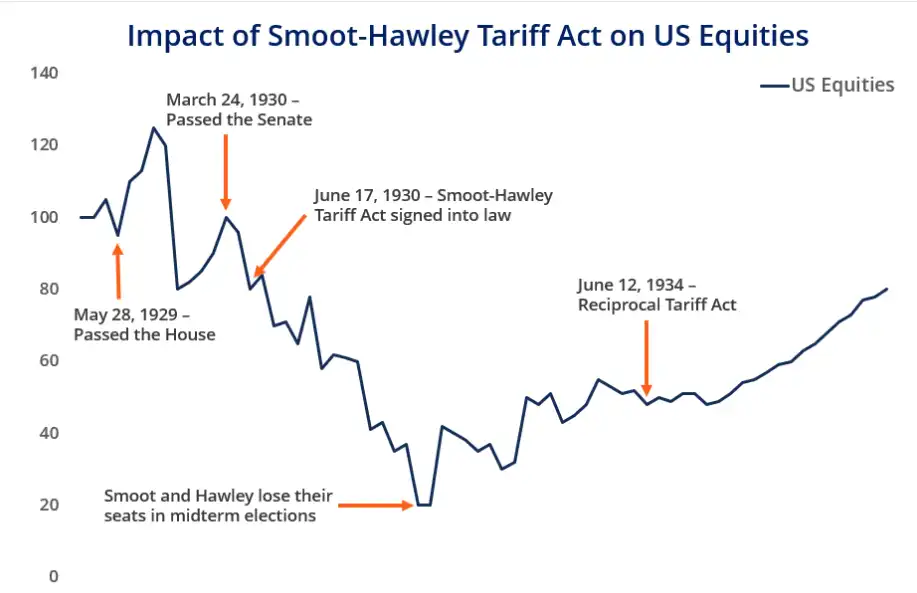

Timeline

- May 28, 1929: The House passed the tariff bill.

- After the bill passed, the markets jumped up briefly.

- After the bill became law, the market dropped constantly.

Comparing Stock Market Then(1930) and Now

There are some similarities between the 1930s and today:

- Strong Bull Run: Both periods had a strong bull run in the stock market before the problems started.

- Economic Growth Concerns: Both periods had concerns about economic growth slowing down.

- Market Correction: Before the tariffs, the market was already starting to correct.

- Tariffs: Tariffs were used to try to protect the economy and create growth.

- Trade War: A trade war started, with countries putting tariffs on each other.

The questions now are:

- Will the markets crash like they did in 1930?

- How much will global trade be affected?

| Situation | Then(1930) | Now(2025) |

|---|---|---|

| Strong Bull Run | ✅ | ✅ |

| Slow Economic Growth | ✅ | ✅ |

| Market Correction | ✅ | ✅ |

| Tariff Implementation | ✅ | ✅ |

| Trade War | ✅ | ✅ |

| Market Crash | ✅ | ❓ |

| Global Trade Impact | ✅ | ❓ |

Related Post: Trump’s 26% Reciprocal Tariff on Indian Imports: 2nd April Announcement

What Could Happen Now

It is hard to say if we will see another Great Depression. In the past, leaders did not listen to warnings. Today, we have more information and awareness.

One possibility is that leaders will change course if things get bad. They could remove the tariffs. However, if leaders refuse to change course, there could be big problems.

The key is whether leaders will roll back the tariffs. If they do not, we could be heading in the same direction as the 1930s.

FAQS

What was the Great Depression of 1930?

The Great Depression was a major worldwide economic crisis that deeply affected people’s lives. In the United States, it is often symbolized by the stock market crash on “Black Thursday,” October 24, 1929. This was just one of the many factors that led to the economic collapse. The causes were complex, ranging from failures in the banking system to declines in industrial production and international trade.

How is the Great Depression similar to today?

There are some similarities between the 1930s and today:

- Strong Bull Run: Both periods had a strong bull run in the stock market before the problems started.

- Economic Growth Concerns: Both periods had concerns about economic growth slowing down.

- Market Correction: Before the tariffs, the market was already starting to correct.

- Tariffs: Tariffs were used to try to protect the economy and create growth.

- Trade War: A trade war started, with countries putting tariffs on each other.

The questions now are:

- Will the markets crash like they did in 1930?

- How much will global trade be affected?

How to Know the Real Price of Gold

What do you think? Will we see another Great Depression, or will things be different this?