Behind the Technology of UPI: How It Handles ₹18.41 Trillion Transactions!

India’s UPI has revolutionized digital payments an suitable, public infrastructure enabling private innovation.

It’s simple, fast, and widely adopted.

What is UPI?

Unified Payments Interface (UPI) is a digital payment system that allows users to send and receive money using a mobile app. It was developed by the National Payments Corporation of India (NPCI).

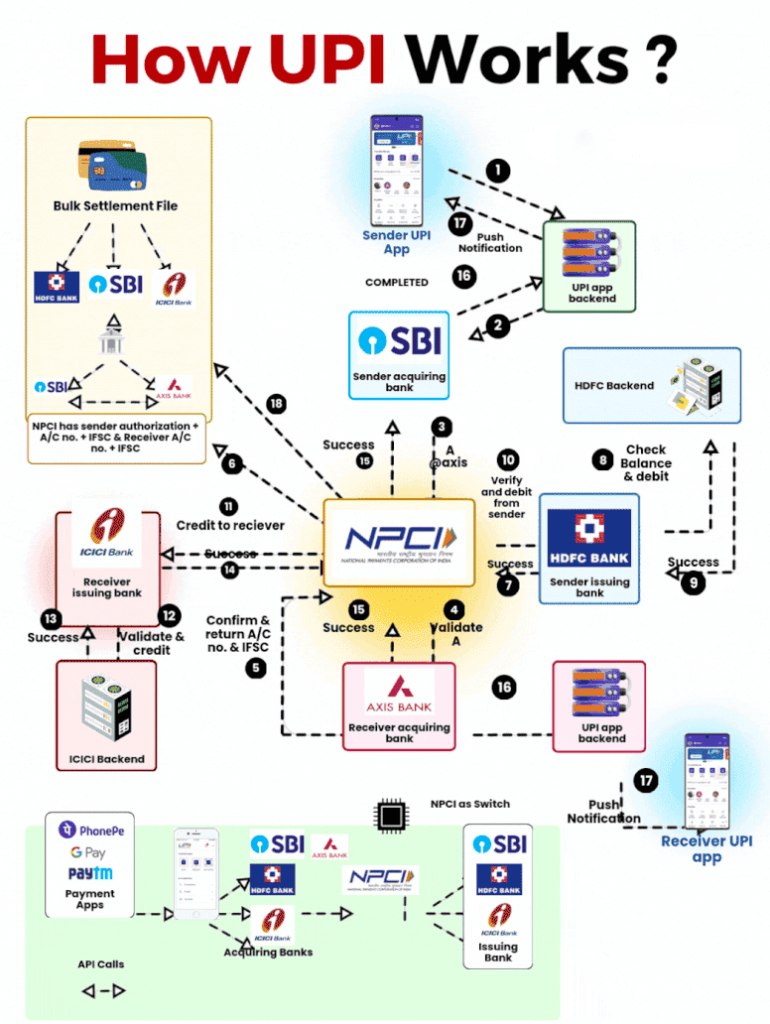

How UPI Works?

UPI links virtual payment addresses (VPAs) like akash@hdfc directly to bank accounts, eliminating the need for IFSC codes. But what happens behind the scenes when you send money?

Let’s break it down:

- Akash(Sender) uses PhonePe to send ₹100 to Anant (Receiver).

- He enters Anant’s UPI ID.

- PhonePe encrypts the request and forwards it to its acquiring bank (SBI).

- SBI sends it to NPCI, which validates Akash’s account and fetches Anant’s bank details.

- NPCI routes the request to Anant’s bank (ICICI) for validation.

- ICICI confirms the details, and NPCI authorizes Akash’s bank (HDFC) to debit ₹100.

- HDFC checks balances, debits the amount, and confirms back to NPCI.

- NPCI instructs ICICI to credit ₹100 to Anant’s account.

- ICICI completes the credit and notifies NPCI.

NPCI ensures settlements between banks via RBI, completing the transaction.

All of this happens in seconds!

Why UPI Works So Well

- Banks: Hold funds & process transactions

- Payment Apps: Link bank accounts & facilitate transactions

- NPCI: The trusted switch ensuring seamless routing & security

This blend of innovation and security has made UPI the backbone of India’s digital economy.

What’s your view on UPI’s future?