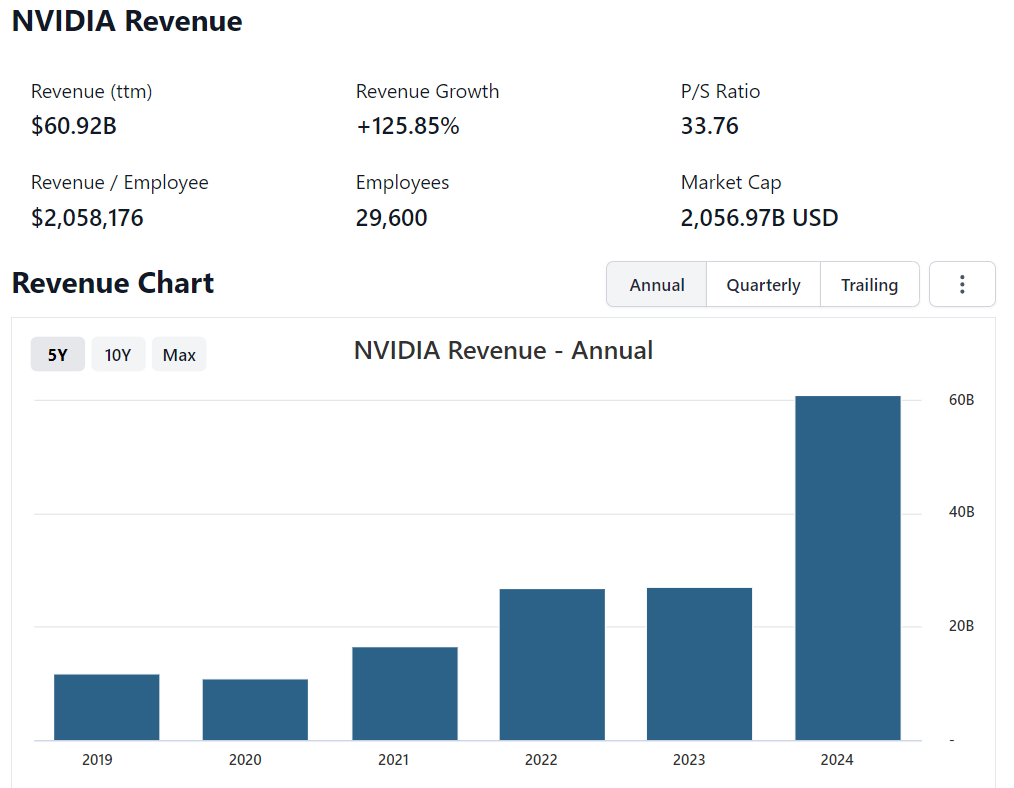

NVIDIA Corporation (NASDAQ: NVDA) achieved incredible financial results in FY 2024 that boosted its net income to levels that were previously unpredictable. Let’s explore the main causes of NVIDIA’s Huge Profit Gain.

NVIDIA Corporation (NVDA) is an American semiconductor company and a leading global manufacturer of high-end graphics processing units (GPUs). NVIDIA is based in Santa Clara, California and holds approximately 80% of the global market share in GPU semiconductor chips as of 2024.

Nvidia designs and sells GPUs for gaming, cryptocurrency mining, and professional applications, as well as chip systems for use in vehicles, robotics, and other tools.

Data Center Business Dominance

The main factor behind NVIDIA’s explosive increase in profits and revenue was its data center division. The business declared net income of $4.37 billion in 2023, a significant decline from $9.75 billion the year before. However, this decline was covered by the significant growth in other areas.

As they race to invest in hardware for AI processing, Nvidia’s major customers include companies like Amazon.com Inc., Meta Platforms Inc., Microsoft Corp., and Alphabet Inc.’s Google. These companies account for about 40% of Nvidia’s sales.

Record Quarterly Revenue

- NVIDIA recorded record quarterly sales of $22.1 billion in the fourth quarter of fiscal 2024, up 22% from the prior quarter and a remarkable 265% from the same period the previous year.

- A record quarterly data center revenue of $18.4 billion, up 27% from the prior quarter and an impressive 409% growth from the previous year, was made possible in large part by the data center segment.

Nvidia’s earnings are insane. Full year revenue up 126%, and quarterly revenue up 265%. “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations” says Nvidia CEO Jensen Huang https://t.co/9NSvBvzX58 pic.twitter.com/h3RIzIccfO

— Tom Warren (@tomwarren) February 21, 2024

AI Madness and AI Generative

- Jensen Huang, the CEO and founder of NVIDIA, highlighted the importance of generative AI. He said, “AI is at an inflection point, setting up for broad adoption reaching into every industry.”

- From startups to large corporations, generative AI’s flexibility and potential piqued their curiosity. With the H100 and its Transformer Engine, NVIDIA’s latest AI supercomputer is currently undergoing full production.

- NVIDIA noticed a rebound in the gaming industry following the pandemic. The new Ada architecture GPUs with AI neural rendering were warmly welcomed by gamers.

Top 10 Tech Companies Worldwide 2023 by Market Cap

AI Cloud Service Providers

NVIDIA launched AI-as-a-service through a partnership with top cloud service providers. Through layers, enterprises may now use NVIDIA’s industry-leading AI platform:

- AI Supercomputer: Through the NVIDIA DGX Cloud, which is accessible on Oracle Cloud Infrastructure and soon to be available on Microsoft Azure, Google Cloud Platform, and other cloud computing platforms, customers can interact with an NVIDIA DGXTM AI supercomputer.

- AI Platform Software: To train and implement massive language models or other AI tasks, enterprises can use NVIDIA AI Enterprise.

- AI Model-as-a-Service: To create exclusive generative AI models and services, NVIDIA provides customisable AI models (NeMoTM and BioNeMoTM).

Gross Profit Margin

According to Finfix, this is the Gross Profit margin on NVIDIA, over the last 5 years.

| Fiscal Year | Gross Profit (USD) | Revenue(USD) | Margin |

| 2020-01-26 | 6.768 B | 10.918 B | 62.0% |

| 2021-01-31 | 10.557 B | 16.675 B | 63.3% |

| 2022-01-30 | 17.475 B | 26.914 B | 64.9% |

| 2023-01-29 | 15.356 B | 26.974 B | 56.9% |

| 2024-01-28 | 44.301 B | 60.922 B | 72.7% |

According to Finfix, Following companies as similar to NVIDIA Corporation because they operate in a related industry or sector. Here also considered size, growth, and various financial metrics to calculate the list is listed below.

| Name | Gross Profit Margin |

|---|---|

| Intel Corporation | 40.0% |

| STMicroelectronics N.V. | 48.0% |

| Information Technology | 49.4% |

| Advanced Micro Devices Inc | 50.3% |

| Qualcomm Incorporated | 55.5% |

| Ambarella Inc | 61.8% |

| Texas Instruments Incorporated | 62.9% |

| Microchip Technology Inc | 67.0% |

| Microsoft Corporation | 69.8% |

| NVIDIA Corporation | 72.7% |

| Broadcom Inc | 74.1% |

| Altair Engineering Inc | 80.1% |

Return to Shareholders

- During the fourth quarter of fiscal 2023, NVIDIA returned to shareholders a whopping $1.15 billion in share repurchases and cash dividends.

- The total return to shareholders for the fiscal year reached an impressive $10.44 billion.

Conclusion

Top 10 Tech Companies Worldwide 2023 by Market Cap

Top 10 stock exchanges in the world 2022

Top 5 Best Stock Brokers in India 2024

Top 10 Best Jobs in USA as per US NEWS, in 2024

In 2023, NVIDIA reached new heights thanks to its major focus on cloud services, generative AI, and data centers. Investors are excited about the company’s next phase of expansion as it lead the AI technologies market and innovates continuously.